Our Solutions

Identifying Needs, Determining Solutions.

Life insurance, annuity, long-term care. We can help with all of it -- and more.

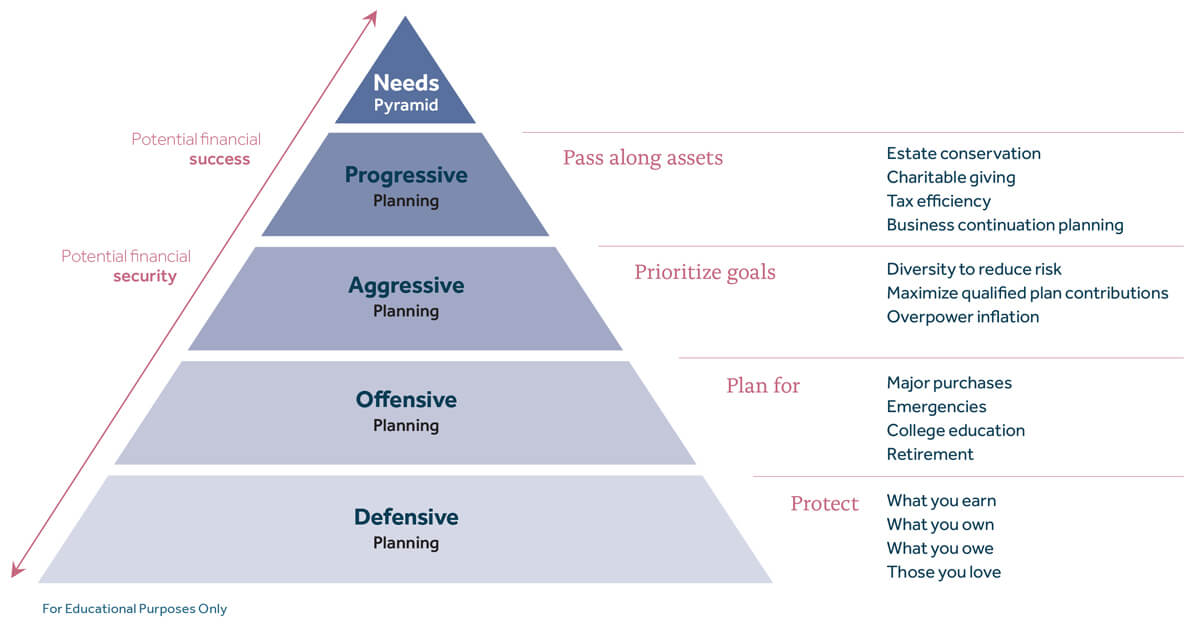

ABOUT YOUR FINANCIAL NEEDS

The team at Ellen Tillman & Company are trained professionals who can help you identify your financial needs and then determine which financial and insurance products can best help you meet your objectives. Some of the products we often use to serve the needs of our clients include:

LIFE INSURANCE

Term Life

Term insurance is perhaps the most basic form of life insurance. It usually provides affordable protection, often with a guaranteed premium, for some period of time. If the insured should die while the policy is in force, the face amount is paid to the named beneficiary. At the end of the premium guarantee period, coverage terminates but the insured can renew the coverage at a higher premium. The premium for term insurance is initially lower than a comparable permanent insurance policy; however, it can increase at each renewal. This initial lower premium usually makes term insurance an ideal choice for individuals with a need for life insurance protection for a finite purpose or amount of time. There is no accumulation of cash value.

Whole Life

Whole Life insurance provides lifetime protection, as long as premiums are paid, and is also known as permanent insurance. In addition to providing a guaranteed* life insurance benefit at a premium that will not increase, it also offers an important way to save for the future, helping you to be prepared for whatever lies ahead. With Whole Life, the cash value of your policy grows tax deferred—which means you can use it whenever you have a need**. Dividends provide an opportunity for additional cash value growth. Though dividends are not guaranteed, New York Life has been paying them to policy owners every year for more than 165 years.

*All guarantees are backed by the claims-paying ability of the issuer.

**Accessing the cash value will reduce the total cash value and total death benefit.

Universal Life

Universal Life Insurance provides a cost-effective way to have long-term protection and the ability to accumulate some cash value. It is best for those who want long-term coverage and are not as concerned with building cash value. Like Whole Life, it is a permanent insurance policy, in that it covers you for your entire life, as long as premiums are paid. Universal Life, however, offers you flexibility that enables you to change your premiums and death benefit as your needs change.

Survivorship Life

Survivorship life insurance - available as whole life, universal life or variable universal life - covers two people and provides payment of the proceeds when the second insured individual dies. Survivorship life insurance is often used to help meet estate planning or business continuation goals.

Variable Universal Life Insurance

Variable universal life Insurance combines the premium and death benefit flexibility of a universal life policy with investment opportunities. You may allocate your premium among a variety of professionally managed investment divisions plus a fixed account. Of course, with investment opportunities comes risk along with the potential for reward.

These products are offered by prospectus through NYLIFE Securities LLC. (member FINRA/SIPC), and a Licensed Insurance Agency.

ANNUITIES

An annuity is a unique financial vehicle designed to help you accumulate money for your retirement and/or turn a lump-sum of money into a guaranteed stream of income payments. Deferred annuities offer the advantage of tax-deferral and can be used to accumulate money for retirement. Income annuities are used to generate a stream of income payments that is guaranteed to last for as long as you need it to - even for the rest of your life*. Some of the different types of annuities are:

*Guarantees are dependent upon the claims-paying ability of the issuing insurer.

Fixed Deferred Annuities

A Fixed Deferred Annuity has an interest rate that is guaranteed* never to fall below a certain amount. For many people, this provides a measure of security. They are offered for a variety of lengths of years.

*All guarantees associated with Annuity Contracts are based on the claims-paying ability of the issuing insurance company. Withdrawals may be subject to regular income tax, and if made prior to age 59 1/2, may be subject to a 10% IRS penalty. In addition, surrender charges may apply.

Lifetime Income Annuities

A Lifetime Income Annuity is an annuity in which income payments begin—one period after the annuity is purchased. It is designed to provide you with predictable income monthly, quarterly, semiannually, or annually, no matter how long you live, and regardless of how the financial markets perform.*

*Guarantees are dependent upon the claims-paying ability of the issuing insurer.

Variable Deferred Annuities

A Variable Deferred Annuity offers the advantage of tax deferral and can be used to accumulate money for retirement. The policy's accumulated value - and sometimes the amount of monthly annuity benefit payments - fluctuates with the performance of your variable investment account options. There are fees, expenses and risks associated with the contract. Please be aware that assets allocated to the investment divisions are subject to market risks and will fluctuate in value. Offered through NYLIFE Securities LLC (member FINRA/SIPC), and a Licensed Insurance Agency.

LONG TERM CARE

Going through life may require a little help along the way. So if you're preparing ahead, long-term care insurance may help protect you or a family member's future and help preserve the assets you've worked so hard to build.

Reach Out

We look forward to working with you and helping you see your visions come to fruition. Contact us for any further questions you might have.

Contact Us Today